Newsletter

Newsletter

Young people in Norway find news subscriptions a pain. Find out what their pain points mean for your publishing business.

22nd June 2023

In the Pugpig weekly media bulletin, Pugpig’s consulting services director Kevin Anderson and digital growth consultant James Kember distill some of the best strategies and tactics that are driving growth in audiences, revenue and innovation at media businesses around the world.

by Kevin

We have a wealth of data that we can bring to bear on decision making such as conversion tracking and propensity to subscribe. However, as we often say here on the Media Bulletin, numbers can tell you how your audience is behaving, but qualitative audience research can tell you why they are behaving that way. Out of Norway, we have a great example that helps understand why young people find subscription news services to be a pain. And it holds some interesting insights that might apply to a wider range of content than just news.

Marianne Borchgrevink-Brækhus and Hallvard Moe, both representing MediaFutures in the Department of Information Science and Media Studies at Norway’s University of Bergen, used the responses from 15 participants aged 26 to 30 to understand “How Young people experience digital news subscriptions”. As Mark Coddington and Seth Lewis point out at the Nieman Lab, Norway is an interesting place to conduct the research because the country routinely tops surveys for people who pay for news. From the Reuters Institute Digital News Report that we highlighted last week, 39% of people in Norway say that they paid for online news in the past year, compared to 21% in the US and only 9% in the UK.

This research is gold dust because, while it’s a small sample (only 15), the research methods are very rich ones with overlapping methodologies. For instance, they used diaries to understand the media consumption habits of their participants. Young Norwegians aren’t disconnected from the news. In fact, they actively looked for it, although some more than others. But they also found that they had gravitated to free sources such as TV, radio, podcast and free national sites as more news went behind paywalls.

For those sources that were paywalled, they had developed strategies to get the information they wanted on specific topics that were of interest to them. They might borrow a login or check out what was being said on social media to get the broad thrust of a story. But they weren’t using these strategies to access these sites generally but only the specific stories that interested them.

But it is also important to note that the participants didn’t have any opposition to paying for news, and they understood that issues around news organisations needed to charge for digital content as ad revenue declined and more audiences abandoned print.

After reviewing the media habits and overall inclination towards paying, the researchers then wondered if there was anything related to their experiences with paying for content and the subscription experience that might be a barrier for them subscribing. Here are the three issues they found:

As we have discussed in the past, there are elements here about establishing the value of your subscription immediately. The work that you do to build habit and loyalty with your audiences is important, and your subscription experience needs to have a great experience.

by James

Last week’s Reuters Digital News 2023 report implied that subscriptions had reached their peak. This week, data from INMA’s benchmarking service suggests that what we actually witnessed in Q4 2022 was a blip. Growth has returned in 2023.

This comes against a backdrop of perceived subscription fatigue. The Kearney Consumer Institute predicted a subscription apocalypse last year citing research showing that 40% of consumers think they have too many subscriptions. Deloitte’s 2023 Digital Media Trends survey backed this up, with 47% of their responders saying they’d made a change to at least one subscription payment amount in the previous year. These numbers include all subscription services, of which news is just a part, but it’s important that publishers consider how they operate in a competitive attention environment. Multiple subscriptions competing for attention and household budgets is especially potent when the factors encouraging subscription fatigue are driven by macroeconomic conditions.

Research earlier this year found that 66% of people reported having subscriptions to film and TV services while only 13% of respondents had subs to magazines and 9% to news outlets, according to a report by FT Strategies and Minna Technologies. And according to Forbes, news is ranked 6th out of 10 categories where consumers feel they get the most value for their dollar. However, 3 of the 4 categories ranked lower than news are not competing for attention and The New York Times is in a list of 10 subscription services that users are most likely to cancel, alongside the Dollar Shave Club and Hello Fresh. News media might not be as much at risk of the subscription apocalypse as books and audio or cloud storage but compared to music, streaming, gaming and education the sector is vulnerable.

Despite this, INMA states that a ‘median news brand’ saw digital subscription volume and revenue both increase by almost 4% against the previous quarter and up significantly more when compared to the first quarter last year. INMA’s data points out that sales in Q1 2023 were only slightly lower than at the COVID pandemic peak in Q2 2020. These are encouraging numbers but the test will be if they continue to grow as headwinds intensify into Q2 2023.

INMA argues that this disproves the assumption that we’re in an attention recession with mass news avoidance. The idea that post-pandemic users’ attitudes have fundamentally changed doesn’t stack up against their numbers. Attention is returning to pre-pandemic levels by most metrics and online sessions are currently 4% higher than in 2019. The Reuters Digital News 2023 report highlighted increases in news avoidance, but as we discussed in last week’s bulletin, 55% of news avoiders are interested in positive news stories, so they remain open to engaging with content.

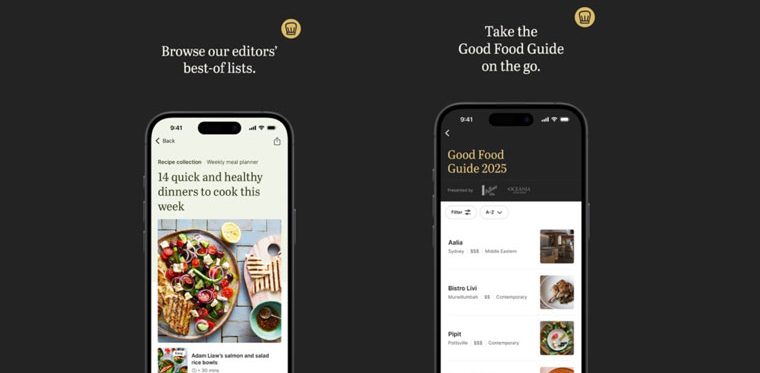

So how are publishers achieving the return to revenue growth? They’re building multi-product subscriptions, like the New York Times which is marketing a premium all-access subscription bundle to users who were previously only paying for one service, such as games. The trial experience is being utilised more, with 86% of top brands offering trials, up 26% in the past year. Those trials are also getting longer, reflecting something that we talk to our clients about a lot, the need to build engagement, habit and loyalty through the trial period to get users to step up to a fully paid subscription. It can take time. When a user is ready to step up, they are likely to now be paying more than they were a year ago, the average trial price increase from last year was 59%, although it can differ for some as price personalisation is getting more widespread. Publishers are squeezing more juice from the same lemons rather than picking new ones off the tree. They are honing more targeted subscription marketing and adding experimenting not just with trial offers but even taster products like FT Edit, games and other niche content like the New York Times Cooking. It looks like there is space for growth and we’re not at the subscription ceiling yet.

Pugpig Consulting can help you navigate these changes with support for revamping your audience development strategies using our proven data-driven process, get in touch.

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter

Newsletter