Newsletter

Newsletter

US subs management company Mather sees a future without print, and we summarise how they see a more profitable future for publishers when they shut off the presses.

15th December 2023

In the Pugpig weekly media bulletin, Pugpig’s consulting services director Kevin Anderson and digital growth consultant James Kember distill some of the best strategies and tactics that are driving growth in audiences, revenue and innovation at media businesses around the world.

If you want to know more about how we are working with publishers like you, get in touch at info@pugpig.com.

Subscription management and customer data analytics shop Mather Economics sees a publishing future without print. At an INMA media subscriptions virtual town hall, Mather’s Pete Doucette, laid out the company’s vision for a more profitable digital-only publishing business model and outlined how to get there.

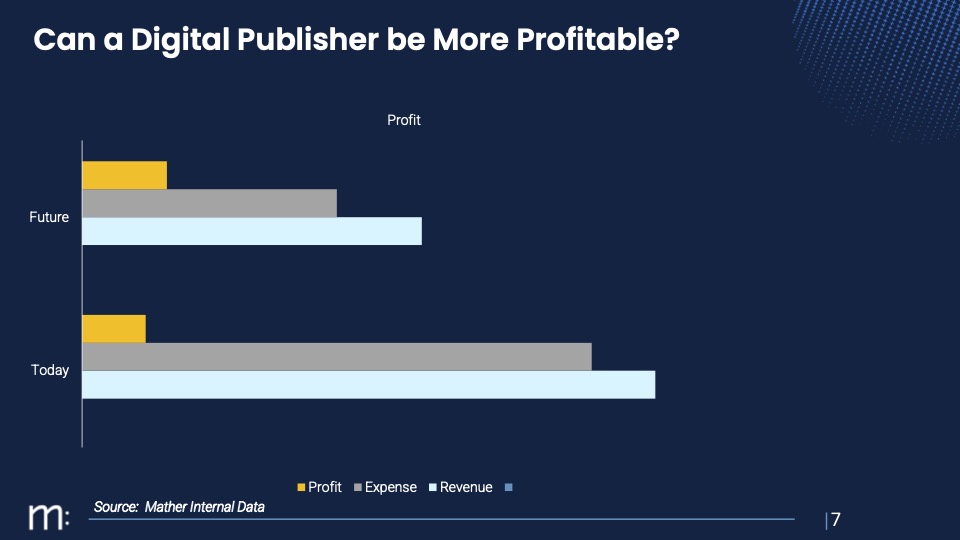

The outlook looked at both the revenue and cost sides of the ledger. Their model anticipates significant costs being taken out of the business with the end of the print. Any publisher will know how much pressure inflation has put on the print business in terms of the cost of paper, ink, production and distribution. Taking this cost out of the equation will be attractive to most publishers, but that would ignore the revenue side of the equation. Print still commands a premium, which is why news publishers have done things like reduce the number of days they print but not shut off the presses entirely. This has led most publishers in the US to try to manage the decline of their print business while transitioning to digital.

However, the news business is changing, and Mather’s models forecast a future when a digital-only news publishing business can be more profitable, albeit on a smaller revenue base, than the current “legacy print business”.

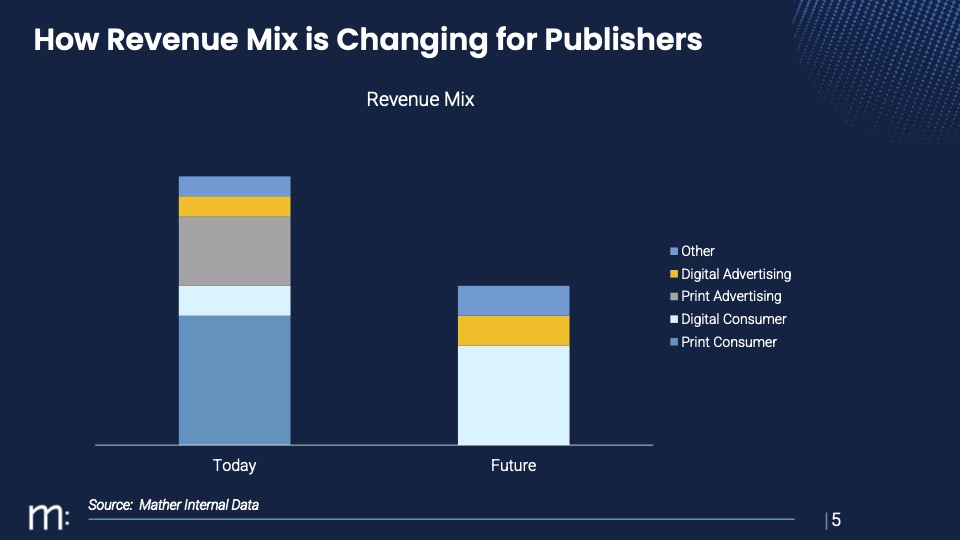

In looking at the current state of revenue, Mather’s model shows how much of a role print still plays for many publishers.

However, Mather also recently released their latest US subscriber benchmark report, which shows that digital is already playing an increasing role in publishers’ revenue mix. The report compiles data from hundreds of US publishers and shows how quickly the print-to-digital revenue mix is changing. In October 2022 the print-to-digital ratio was 60/40 in print’s favour. A year later, it has shifted to 52/48, and if it continues at this rate, we would expect the overall number of digital subscribers to overtake the number of print subscribers in early 2024. According to Mather, more than two-thirds of new starts (68%) were for digital-only subscriptions, and whilst the churn rate was higher for digital than print, running at 3.93% compared to 3.39%, this was not enough to put the brakes on digital subscriber growth.

However, the revenue gap between the two subscription types remained heavily skewed towards print, which delivered 77% of total subscription revenue. This was due to a big difference in the median monthly subs rate. For digital it stood at $8.44, whilst a median monthly print sub was almost 4 times higher at $30.45.

This doesn’t necessarily mean that publishers have missed a trick by not selling enough print. Acquisition of print subscribers remained significantly more expensive than digital. A median digital subscriber acquisition cost was just under $8 whilst the median print acquisition was almost four times higher ($29.95). This goes a long way to explain the almost identical difference in pricing of the two products and the overall dominance of print in the revenue mix. It also highlighted the challenge that publishers have as they attempt to adapt to an ever more digitalised world.

The impact of churn was also under the spotlight. According to Mather, revenue lost from stops outpaced revenue gained from starts. Median start revenue stood at $55 but the median stop lost revenue was $460. This means that US news publishers remain in a bind where they have to continue to drive high volumes of acquisition to make up for the shortfall.

Another thing to note from the subscriber benchmark report is the difference in performance based on the size of the publisher. Larger publishers, those with more than 100,000 digital subscriptions, were able to charge more, and smaller publishers saw higher churn levels, between 4.3% and 5.5% for the smallest two cohorts.

The report also highlighted differences between the leading performers and the median, and the results showed how these high-performance publishers are starting to increase digital ARPU. At the start of a digital subscription, the typical price charged by a leading publisher was $2.03, 11% lower than the median price of $2.29. However, when it came to the stop price, the leading publisher had increased their subscription more than 6 times to $12.75. They outpaced the rest of the field, where the median price increased by less than 4 times to a significantly lower $8.56.

An important element of increasing ARPU is retention, and leading publishers, such as Die Zeit, have focused on demonstrating the value of their products during the initial subscription phase is critical to retention efforts. We regularly use this bulletin to highlight the need to build loyalty with an audience from the very start of their subscription, to achieve the highest possible chance of renewal.

That is the current state of the market, but with leading publishers increasing digital ARPU, the outlines of the future that Mather envisions start to take shape. They see the possibility of a publishing future that is more profitable than the current business.

This future business looks smaller, but Mather believes that publishers can maintain a similar-sized newsroom or editorial team. The general and administrative costs will decrease, but they see a larger spend on sales and marketing and technology.

The key question is how publishers will make the transition. Based on the experience of US publisher Newsday, Mather has split activities into the sports-related metaphor of offensive, digitally-focused, and defensive, print-focused activities. Publishers will have to continue to reduce and manage the costs of print. At Newsday, that has involved reducing fixed costs with their print products as much as possible and transitioning them to variable costs so that they can be managed more effectively, said Patrick Tornabene, Chief Consumer Officer. And digital plays a role in maintaining print engagement, he said. They found that the decline of their print subscribers who weren’t digitally engaged was slightly lower than market trends, about 9%, while the decline for those who were digitally engaged was only 2%, Patrick said.

For the offensive “transformation levers”, Mather offered up a range of tactics that will be instantly familiar to publishing leaders including growing digital subscriptions and ARPU as well as growing digital advertising. They also add something that we’ve written about often here at the Media Bulletin, which is an expanded digital product portfolio with smart use of bundling. They see new opportunities to leverage technology, particularly AI, which can automate processes as well as optimise content distribution and presentation and drive smart paywalls to increase subscription conversion and retention through personalisation. At Newsday, Patrick said that they used propensity-to-subscribe models and algorithms to establish their paywall model.

When will it happen? Mather doesn’t take a view on the horizon, Pete said but added that they believe it will play out in the US over the next five to 10 years.

In a rough year for media in the US, Newsday shows that success is possible, with subscriptions up 11% and revenue up 20%. They aren’t ready to shut off the presses yet and still have print in their five-year plans, but they are realising the importance of digital engagement for print subscriber retention. They are achieving their success with many of the tactics we at Pugpig Consulting support our customers in executing, including audience segmentation, “aggressive” onboarding and testing. If you want to know more about how we can support your success, please get in touch with us at info@pugpig.com.

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter

Newsletter