Newsletter

Newsletter

Subscriptions alone won’t sustain most media businesses. We look at how to balance diversification and strategic focus.

5th January 2024

In the Pugpig weekly media bulletin, Pugpig’s consulting services director Kevin Anderson and digital growth consultant James Kember distill some of the best strategies and tactics that are driving growth in audiences, revenue and innovation at media businesses around the world.

If you want to know more about how we are working with publishers like you, get in touch at info@pugpig.com.

In the final edition of the Media Bulletin for 2023, we spoke about the need for strategic clarity. As the year begins, INMA has revealed a conversation in which media executives questioned whether the industry had become too focused on a single goal: subscription growth. Could this lead to blind spots concerning the business and mission of journalism and keep media in general from having the impact it could?

The question came up during INMA’s semi-annual board meeting in November. “What if the news industry’s total focus on subscriptions as the saviour of journalism has unintended consequences for the impact and influence of news brands,” asked Alexandra Beverfjord, executive vice president of Aller Media in Norway.

Would “the news industry’s total focus on digital subscriptions … soon have the net effect of producing journalism for fewer people?” she asked, according to Earl Wilkinson, the executive director and CEO of INMA.

Will journalism be available only to those who can pay, the “wealthy and well-educated”?

Let’s unpack the issues, with a lens on what they mean with respect for the challenging balancing acts that will face not only journalism but all media businesses in 2024.

Some of this boils down to some of the classic church-state/editorial-commercial tensions that have long existed in media companies. Public service and commercial journalism organisations have a sense of responsibility in democratic societies, including distributing information to as many people as possible. If they only reach a small, elite audience, it runs counter to public service mission goals, even if they are commercial organisations.

A broader question that often enters these conversations: Where do people who don’t or can’t pay get their news from? Editors have been replaced by algorithms for many people. We were reminded of a recent edition of Joyce Vance’s “Civil Discourse” Substack in which, much to her horror, she found out that a “young, smart … recent college graduate” friend didn’t know who Rudy Guiliani was. Her 21-year-old son quickly gave her a lesson on the filter bubbles, explaining that most college-age people get their news from social media feeds. Based on that, the only news he had seen that day was about chess and rap music.

However, Alexandra Beverfjord’s questions are also relevant to non-news media organisations because they speak to the balancing act between impact and influence. This requires a certain level of reach, and subscription revenue, which will always be a subset of the total audience. It also speaks to tensions in media businesses. Advertising sales want reach and volume and worry that putting content behind a paywall might negatively impact that.

More than a decade ago, publishers started to address these tensions by rolling out metered paywalls, allowing loosely connected audiences to sample their content in a way that enabled the publisher to retain most of the reach while also converting their more engaged audiences to subscriptions. This has evolved even further by adding registration, newsletter sign-ups and other paths to adding known users that allow them to start to build up data for editorial and commercial purposes. This deeper knowledge of audiences can improve advertising yields, drive subscription conversion and retention and also provide data for marketing efforts for new products.

For some, this has yielded tangible benefits. Bloomberg moved away from third-party ads in 2022 because of the wealth of first-party data that it had amassed from 450,000 subscribers and more than 5 m registered users. Registration has become a powerful tool for publishers, and while North Star goals often focus on growing subscribers, increasing the pool of known users has become a powerful part of that overall strategic goal.

However, there is a realisation that while growing subscribers has been an important element in righting so many ships in media, audiences and media companies are all grappling with subscription fatigue. It is due to several well-known factors including competition for subscription revenue, the cost-of-living crisis and limits on subscribers in any audience. The cost-of-living crisis was listed as the most common reason for cancelling a subscription, according to the Reuters Institute’s 2023 Digital News Report. Most publishers who pivoted to reader revenue models long ago converted their most engaged audience members into high-ARPU subscribers.

INMA Researcher-in-Residence Greg Piechota said that subscription fatigue is real and that it is in part driven by “‘going to the well’ too often”. Price increases and higher-priced bundles can only grow subscription revenue so much, and this will continue to be a challenge as household budgets are squeezed. In the US and UK, the higher prices of housing and mortgages are increasingly weighing on disposable income.

While many publishers still see headroom for growth in their subscription businesses, at Pugpig Consulting, we are often asked about where the next source of revenue growth will come from. The 2023 ad market was bruising, and INMA said that this is leading to “advertising avoidance” amongst C-level leaders. As WAN-IFRA found in its Press Trends report last year, the fastest growing segment wasn’t seen as subscriptions or advertising but other revenue sources, including events, e-commerce and revenue from platforms. They forecast that these revenue sources and others will account for almost a quarter of their revenue going forward.

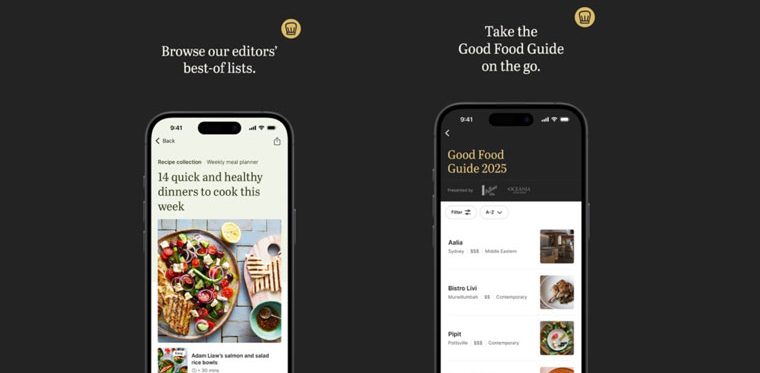

Greg highlighted India as a source of inspiration for media leaders looking for new revenue streams and new products that command premium prices. Indian publishers are leaning into content-to-commerce models, such as the New York Times’ Wirecutter. Indian publishers are also creating premium subscription products for diaspora audiences and audiences of passion subject content, such as cooking. For example, Hindustan Media Ventures has expanded its product portfolio from newspapers and magazines to several innovative digital businesses. The group’s Slurrp, food and recipe digital property, is leveraging the “content, community and commerce” model to grow an audience to 4.5m monthly users. These users are delivering more revenue through a shopping experience. Hindustan Media Ventures also incubated a streaming video aggregator and discovery service called OTTPlay. The service allows a user to pay a single subscription to access six curated bundles from 28 streaming video providers.

The challenge for media executives will be which of these new revenue sources to focus on. At a CEO roundtable hosted by INMA last year, media leaders agreed that leadership teams could only focus on at most four business models. If a business tries to do too many things, they often end up doing them all equally poorly.

And that brings us back to strategic clarity. Focusing on subscriber growth has been transformational for many publishers. This has allowed the Financial Times to create a new revenue stream by building a consulting wing to sell its subscription-focused, data-driven North Star framework. The New York Times has used the foundation of reader revenue to diversify its product portfolio through acquisitions.

However, the FT and the NYT are part of the “winner takes most” cohort of global publishing businesses. Not everyone can be the Times. What lessons can be learned from them that apply to local news publishers or consumer magazines? And how can these lessons address the concerns raised at the INMA board meeting?

Media leaders will need to balance focus and product-revenue diversification.

As INMA says, subscription revenue alone will not sustain most media businesses. The shift to reader revenue has greatly enhanced the audience focus of many media businesses, and that is an important strategic result. Media companies understand that they have to diversify so that they are not solely reliant on the traditional twin pillars of media businesses – advertising and subscriptions. They will need to explore content-to-commerce models, events and other products and revenue streams.

Audience research is key to achieving product-market fit.

Part of the transformation driven by subscription-focused businesses is a focus on audiences. What do they need? This has led media companies to embrace innovation frameworks such as design thinking or human-centred design. It can help generate ideas that meet specific needs that your audiences have.

Media companies can focus by assessing their capabilities.

Design thinking is useful in focusing on user needs and generating new ideas. In filtering opportunities to diversify, one lens to help focus on which opportunities to pursue is the existence of current and latent capabilities. For many media companies, especially those under stress, it makes little strategic or financial sense to try to build products that sit far outside their wheelhouse. The New York Times can diversify because it has built from its foundation of reader revenue out to new product lines.

Create business models that align with your editorial mission

Anton Protsiuk at The Fix brings us full circle to the concerns raised in the INMA board meeting: Your business model needs to be aligned with your editorial mission. While journalism organisations have professional values that inform their missions, all media organisations have editorial missions. This is important because values help motivate teams, especially during times of change, and this period of change is especially turbulent. Publishers know that as much as they need to retain subscribers, and to achieve all of their editorial and commercial goals, they also need to retain talent. As Anton says:

“A good business model isn’t possible without people (assuming your model isn’t to flood the zone with AI-generated content – and I hope it isn’t). Media organisations are often bad at retaining talent. People get tired or burnt out and leave in pursuit of better-paid opportunities.”

As we start 2024, we not only wish you the best of luck, but we know that we can help you on your journey. If you need help with your app strategy, growing your audience and growing your revenue, get in touch. You can find out more about what we do and how we’ve helped other publishers like you at Pugpig.com.

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter

Newsletter