Newsletter

Newsletter

We review how publishers can reduce subscription journey friction to increase conversion via mobile.

24th January 2025

The mobile revenue opportunity for publishers is growing as subscription conversions shift from desktop to mobile and revenue from in-app purchases grew in the UK and Europe.

Last year, in-app revenue grew for news and magazine publishers by 62% in the UK, 89% in Germany and 37% in France, according to data from Sensor Tower.

Moreover, mobile web surpassed desktop for subscription conversions in the past two years, according to subscription benchmarks from Piano.

The data shows how much revenue opportunities for publishers and broadcasters have shifted from desktop to mobile in the past two years.

Data from our 2024 State of Mobile Publishing report shows that most paying app users are direct subscribers who have linked their subscriptions to the app. This underscores the importance of optimising subscription journeys for mobile audiences. Just as content strategies have shifted to mobile-first so must commercial strategies.

To optimise mobile revenue opportunities, publishers and broadcasters need to:

We had a conversation about ELE in our Mobile Matters community this week. If you’d like to join, you can sign up here. And if you would like to talk to our on-staff experts and consultants about how to grow your mobile subscriptions, get in touch.

By Kevin Anderson

Subscription trends over the last two years track familiar shifts in media.

In their benchmarks report, Piano provided another data point to show the scale of the collapse in social media traffic. Across media sites, referrals were down from Facebook 34.2% and X a staggering 48.8%. Political sites were particularly hard hit, according to Katelyn Belyus, Global Vice President of Strategy and Analytics for Piano. Traffic from Facebook to political sites was down 60%.

Google traffic was up by 9.4%, but she added that much of this increase was due to Google Discover. While publishers can and do see organic traffic from Discover, she said some traffic is based on contractual agreements with the search giant which include clauses that require publishers not to paywall content that appears in the service.

However, Google did provide a meaningful source of conversions for publishers providing 24% of conversions from search and social referrals, while Facebook only delivered 1% and X a meagre 0.48%.

This has contributed to flat traffic growth for media sites, up only 5% in the past two years. However, publishers have continued to increase revenue despite this, even amongst the 46% of Piano customers who saw a decrease in traffic, 76% were still able to increase their revenue.

The other major shift has been that revenue is finally following the audience shift to mobile. In early 2022, desktop conversions still made up the majority of conversions, 69% in March of that year. However, a little more than a year later in April 2023, mobile conversions overtook desktop for the first time and have stayed in the lead since March 2024.

Publishers also need to increase engagement with their audiences to drive conversions. Piano found across publishers only 1.2% of users are known while 66% are loosely connected unknown users, visiting a publisher only once. Publishers should implement strategies to encourage repeat visitors to become frequent visitors through content recommendations and newsletter subscriptions.

Propensity modelling is being extended to likelihood to return to help with this process. Smaller publishers may not be able to take advantage of these models due to a lack of sample size to make them effective, but Katelyn said A/B testing can be applied to achieve the same goal to deepen engagement with audiences.

Publishers also need to balance the flexibility consumers find in monthly subscription offers versus the higher lifetime value of annual subscriptions. Publishers should implement pricing that makes annual subscriptions more attractive through discounting versus monthly offers, Piano recommends. Publishers also offer premium tier subscriptions or memberships based on unique content or experiences.

As we found in our latest State of Mobile Publishing report, publishers have adapted to the challenges of new user acquisition through multiple strategies to increase the average revenue per user. Piano found that publishers on average have increased their ARPU by 21% since 2022.

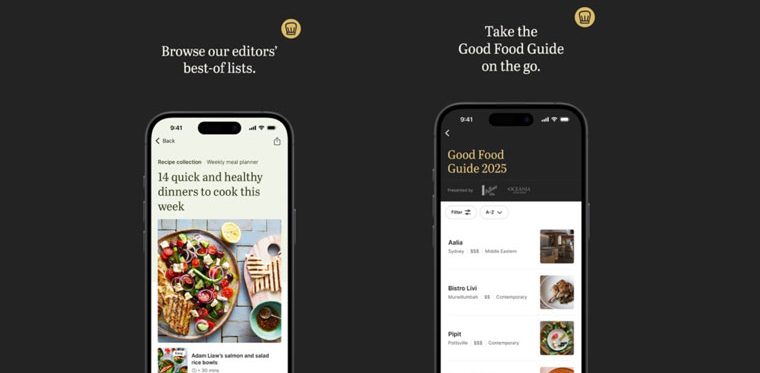

To take advantage of the shift to mobile, publishers have had to improve the user experience of their mobile subscription journeys. In their 2022 subscription benchmarks report, Piano found that “42.4% of paid offers are completed on desktop vs. 19.7% on mobile, highlighting the importance of minimising checkout friction for a great user experience.”

Publishers have made progress in reducing this friction by optimising every step of the conversion process from when offers are displayed, to checkout and payment.

Everything on mobile needs to be streamlined. Language needs to be simplified in subscription CTAs, highlighting the price and clearly and concisely communicating the value of the offer.

Just as vertical video provides a better user experience for mobile audiences, Piano recommends testing vertically stacked variants of offers or even single offer templates.

Piano also recommends frictionless payment methods, offering subscribers simple payment options. Digital wallets such as Apple Pay, PayPal, Alipay and Google Pay are available in dozens of countries and allow users to pay for purchases rapidly and securely.

When asked about optimising subscription experiences, Katelyn said publishers should focus on “testing, testing, testing”.

Test the CTAs, the offer language and checkout flow as well as pricing, trial offers, tiers and bundles.

The data also highlights the opportunity for publishers who have opted for Apple’s External Link Entitlement option to use their own subscription journeys for their apps rather than use Apple’s App Store process.

With direct relationships with customers becoming essential, ELE cuts out Apple as the middleman between you and your subscribers or members. After optimising your mobile web conversion process and seeing improved conversion rates, ELE could help media companies better meet their goals. The benefits are clear:

Moreover, Apple has also loosened the terms for the ELE process for EU-based publishers. Publishers have much more in the design of subscription communications and the offers they can provide using ELE.

There are some downsides for ELE, especially if you already have a large base or high percentage of in-app subscribers as you will need to cancel all of them and have those users re-subscribe using ELE, which presents a churn risk.

However, the hard work publishers invest in optimising their mobile subscription process could pay off richly in higher conversion rates and the ability to keep more of your revenue.

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter

Newsletter