Newsletter

Newsletter

Subscriber growth is slowing or has stalled for many publishers, but new techniques and technologies offer opportunities to restart this growth engine.

14th February 2025

For the media business, 2025 has started with three major themes driving most of the conversations: the Creator (Influencer) Economy, AI and revenue.

We will be diving into AI soon and in great depth, but for us, the year has started with enough alarm bells about revenue that we feel it is urgently necessary to focus on solutions.

The Reuters Institute and recent data from the AOP in the UK both point to subscription revenue growth stalling or at least slowing In a response to the Reuters Institute 2025 digital trends report, FT Strategies laid out the challenge starkly by saying that “margins in the news are calling into question the future of for-profit journalism”.

Despite the slowing of growth in subscription revenue, that doesn’t mean there aren’t opportunities to return to growth including a mix of offence and defence:

Mobile Matters, our community for Pugpig customers and those interested (or expert) in mobile publishing, will hold its first workshop on 27 February at 15:30 GMT/10:30 ET. This first workshop will be focused on participants discussing how they are getting the data they need from their apps with support from Pugpig’s analytics and insights experts. If you’d like to take part, you can join Mobile Matters here.

And if you’d like to discuss revenue options with us, simply reply to this email.

Kevin & James

By Kevin Anderson

The value of subscriptions to publishers is clear and has only increased with increased competition and volatility in advertising. As subscriber acquisition has become more challenging, publishers must work harder to communicate their value proposition more clearly.

Slowing subscription growth has been driven by the fact that in most markets publishers have already converted the low-hanging fruit, their most engaged users, and retention has become more important.

Building habits with new registered and subscribed users is critical to support retention. Die Zeit found after launching a push to acquire new subscribers they had inadvertently created a leaky funnel. They reduced churn by embedding onboarding messages in their content, promoting the app during onboarding and allowing new subscribers to personalise their experience to make it more relevant to them.

AI is also supporting retention efforts by identifying which activities support retention and identifying users at the highest risk of churning. Hearst Newspapers worked with Mather Economics to identify activities most tied to retention. Web visits, newsletters received, e-edition visits, app visits and newsletter clicks were the top five activities most tied to retention. They then ran email and social media campaigns that targeted those at-risk users and boosted engagement by up to 11%.

Counterintuitively, providing subscribers with the flexibility to suspend, or even to cancel, supports retention. Almost three-quarters of customers (74%) say that this level of flexibility – including free trials, the ability to pause or cancel and multiple payment options – is the top reason a customer chooses to subscribe, according to Recurly. Moreover, 65% of customers would consider cancelling a subscription if they couldn’t customise it.

Using data, machine learning and generative AI to understand and communicate the content that converts has allowed publishers to unlock impressive subscription growth. The United Daily News Group (UDN) began a comprehensive data-driven digital transformation programme in 2021, according to a case study by WAN-IFRA. With 7.3 m registered users, UDN boasts the largest store of first-party data of any media group in Taiwan.

UDN has developed a platform called Curate X, which creates a dynamic model connected to a central data system to produce “precise content development strategies” to engage audiences through more relevant content, Lin Yi Lin, the Data Development Department Manager at UDN, said.

The results are impressive. In 2023, membership grew 180% and subscriptions grew 230%.

UDN, as with many other publishers, is feeding this data into models to optimise conversion.

Publishers have used propensity to subscribe and churn models for years, but these have tended to be static. With more powerful AI tools, they are transitioning from these models to predictive analytics to drive dynamic paywall offerings. INMA found that one-fifth of the publishers it surveyed in 2024 had implemented some kind of dynamic paywall and another third were planning on implementing them.

The hunt for revenue has led publishers to try to increase the average revenue per user (ARPU). The efforts have focused on selling premium memberships, services and super-bundles.

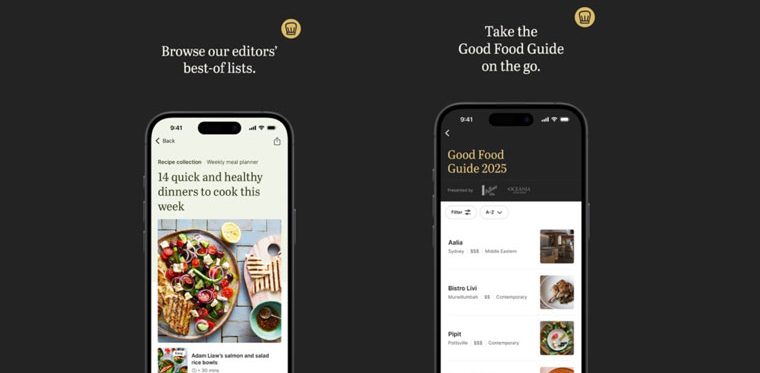

Consumer magazines have focused on premium memberships and unique in-app offerings such as personal training advice that Hearst UK added to their Men’s Health and Women’s Health apps.

INMA’s Greg Piechota recently did a thorough review of bundling models:

International – The New York Times has been the leader in bundling, often through acquisition. It bought the Wirecutter review site, The Athletic sports site and Wordle to supplement its growing puzzle offering.

National + Local – Amedia in Norway developed a product that bundled its national and local titles, and they went through an iterative product development process to find product-market fit by developing improved discovery.

Owned + Competitor – For local or regional-only publishers, they are testing bundling with a competitor. Readers of Denmark’s Politiken or Italy’s Corriere della Sera are part of a trial the New York Times has launched, bundling with other publications. It adds value for European audiences and introduces them to the US title.

As Greg points out, publishers can see a major uplift in lifetime value (LTV) with only minor increases in ARPU through bundling.

The increase in LTV is due to an impressive improvement in retention. “You make more money with higher retention than with higher price,” Greg told Damian Radcliffe in a review of subscription trends for 2025.

Amedia has decreased its monthly churn rate by 96% with its digital bundling strategy, leading to 26x average LTV over a single local subscription.

I’ll bring up one final opportunity. In the Reuters Institute Digital News Report last year, they found many more readers were open to paying something for content, even if not a full subscription.

Publishers are capturing some value through paid trials, but other lower-cost offerings could increase their paying audience and act as the starting point for a full-price relationship.

All of this offers hope. Publishers have converted their loyal audiences to digital subscriptions, but these remain a fraction of their total digital audiences. Fortunately, there are many proven and evolving strategies and options that can grow the pool of readers, listeners and viewers willing to pay for your quality content.

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter

Newsletter