Newsletter

Newsletter

Newsquest Scotland’s focus on growing digital subscriptions and Amedia’s local news bundle offer ways to address the crisis in local journalism.

28th March 2025

Local journalism is in crisis across the English-speaking world. In the UK, 293 local newspapers have closed since 2005, according to the Press Gazette. In the US, the number of closures is more than ten times higher, with 3,200 print titles closing since 2005 and closures happening at the rate of two per week, based on data from the State of Local News Project at Northwestern University.

National and financial newspapers such as the New York Times, The Times and Sunday Times in the UK and the Financial Times have remade their business models focusing on reader revenue. However, regional and local titles have struggled to find the same success with subscriptions until now, and this isn’t just among digital start-ups but also major news groups.

It shows how regional and local publishers, operating at scale, are finding ways to build a solid foundation based on digital subscriptions. Most of the publishers Pugpig works with have subscriptions as a core part of their revenue model, and their apps play an important role in retaining subscribers. Edward Roussel, the head of digital at the Times and the Sunday Times, says that their app users are 50% more likely to renew their subscriptions than non-app users.

They also offer resilience in the face of many changes in media, including AI. They are focused on building and sustaining direct relationships with audiences and on original reporting and content that will be augmented but not supplanted by AI.

Strategies for optimising app revenue and driving subscriptions are two of the topics that we discuss in Mobile Matters. In addition to a Slack community and strategic guides on our Community Hub, we also hold workshops allowing you to hear from your peers about tactics that work. You can sign up to join here.

By Kevin Anderson

Local publishers have been trying to find a business model that will offset the declines in print subscriptions and advertising as pressure continues to build on that market. In the UK, no regional newspaper has a print circulation of more than 20,000. Daily circulation fell 16% year-over-year from 2023 to 2024, and non-daily circulation fell 14%. However, overall, digital editions grew by 0.5% across titles tracked by the Press Gazette. Publishers are leaning into growing audiences, particularly paying subscribers, for their digital products.

To achieve that, many publishers, like Newsquest’s Scottish operations, have been engaged in digital transformation programmes. Its papers, led by editor-in-chief Callum Baird, are told not to worry about pageviews but to focus on quality content that drives subscriptions and engaged, loyal audiences. Instead of trying to do more with less, the strategy is focused on doing less that is better with stories that drive the conversation in Scotland and engage audiences to convert them to subscribers. At the Herald, editor-in-chief Baird says they dedicate small teams to deeply reported stories on a single subject, which they publish over the course of a week, with examples like the future of Glasgow or depopulation in the Highlands.

At their Scotland national titles, The Herald and The National, they have increased digital subscribers by 10,000 in the past 15 months. The group now boasts 40,000 subscribers overall, including 6,000 digital subscribers at its local titles and 10,000 subscribers at standalone sports sites, which were only launched in the last four years.

Subscriptions to the sports sites include an ad-free phone and tablet app, exclusive data, multimedia projects, a flexible payment plan and easy options to pay, including PayPal. They gambled on the hypothesis that deeply reported stories “rather than clickbait” with more general stories from a central sports team across Newsquest Scotland would build a community of dedicated, paying subscribers, which has proven correct. For example, they recently wrote a single in-depth piece about a possible takeover of Rangers by US investors, which led to 800 new subscribers in 10 days.

More than the growth in subscriber numbers, subscription revenue has paid for the newsroom at The National for several years, Callum said.

Newsquest Scotland has demonstrated the value of differentiated content and a diversified product and revenue approach. Its smaller local titles have a higher meter, allowing more articles to be read before a paywall is shown. At its standalone sports site, they have leaned into high-quality video on YouTube to feed fans’ demand for news and commentary about the club they support. And not all of their new digital properties are sites. They have also launched Substack-based newsletters, including the Killie Chronicle, covering Kilmarnock FC in Ayrshire, and The Glasgow Wrap, which curates news from its titles and other local sources. Subscribers who pay £5 to The Wrap get additional content, including “a weekend guide, weekly culture newsletter and an original Sunday long read”.

Newsquest Scotland shows how a regional publisher can transform their digital operations and build a post-print business. By developing a range of products all focused on growing digital subscriptions, they have reached profitability, and as other publishers have seen, establishing a strong commercial foundation built on reader revenue provides them with the stability and resilience to continue to experiment and grow.

The New York Times built on its subscription success by acquiring or developing a range of editorial products it promotes as part of a super bundle. It’s allowed it to increase its average-revenue-per-user.

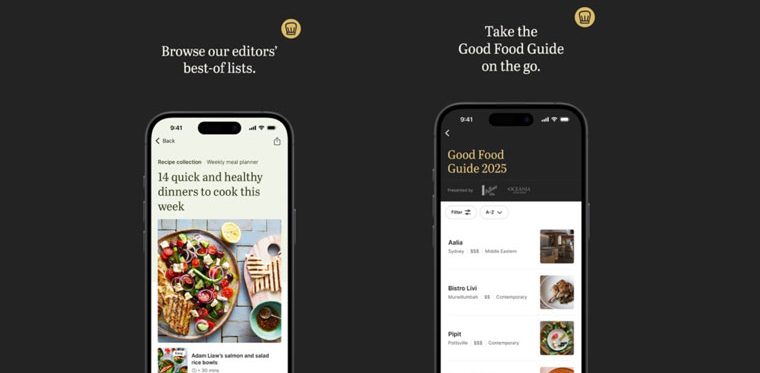

Other publishers are looking to emulate its success, and Norway’s Amedia has developed a model based on a user need it identified – easy access to content from its 127 local news sites across Norway. Nearly five years ago, they launched a subscription bundle, +Alt, after they found that subscribers were paying to access more than one title and didn’t like having to remember multiple log-in details. The subscription includes access to all of its sites and a sports streaming service. After refining the product to improve discoverability, they found product-market fit, smashing their initial goal of 50,000 subscriptions by adding 120,000, 86,000 of which were new, within eight months after launch.

Soon after the launch, they added a personalised onboarding process and continually work to refine the product. Within a year, “Amedia has shown a revenue growth of several million Norwegian Krones every month,” Ole Werring, Chief Product Officer, Amedia Utvikling AS, told WAN-IFRA.

They found that +Alt subscribers often dropped their individual subscriptions, which could have been a concern, but the bundled subscription, which costs 11% more than a subscription to an individual title, is driving dramatically higher life-time value (LTV) by attracting new subscribers who churn at a far lower rate.

INMA’s Greg Piechota, laid out the success of Amedia’s bundle in stunning stats.

This is a model that many newspaper groups should consider to unlock the value of all of their journalism. It’s important to remember Amedia’s efforts to refine their product, which is a masterclass in news product management.

With the sense of crisis in local news, it is exciting to see how a focus on high-quality, differentiated content, product experimentation that includes newsletters and apps, plus bundles, are offering tactics that local publishers are using to not only reverse the decline of local journalism but also drive dramatic new growth.

We are busy collecting data across our stable of more than 400 apps to produce our annual State of Mobile Publishing report. We have already identified the publishers whose app performance stands out. We are speaking to them for case studies about how to drive audio engagement and increase revenue by using Apple’s External Link Entitlement or adding membership tiers and features to their apps. To make the report as rich and actionable as possible, we want to hear from you. Please take our survey about where apps fit into your overall strategy and what your mobile publishing plans are for the coming year.

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter